When not to automate in accounting

We all know that automation can save time – but when is it better not to? Here, we’ll explore some cases when it’s best to do things manually instead.

In August of last year, Gartner noted that hype around AI had reached its peak. Accounting was no exception – there’s been a lot of excitement in the field about how generative AI can speed up workflows and save time.

Yet it’s also important to know what not to automate. User-friendly generative AI like Copilot and ChatGPT are dominating the market because everyone can use them, but their accessibility also poses a risk.

Below, we’ll take a look at some of the situations where automation isn’t the answer.

When a task requires high-level analysis

In August, one study found that ChatGPT didn’t always perform as well as students on accounting exams. While it was great at answering yes or no questions, it got less than 40% of short answer questions right.

Generative AI can sound convincing, but that’s only because it’s great at language – not at nuanced judgment, creativity, and strategic thinking. Chatbots hallucinate more often than many people think, making them less ideal for tasks like high-level financial analysis and advice.

A recent example was Air Canada’s customer service chatbot, which made up a refund policy that the airline then had to honor. Translated to tax services, these hallucinations could be disastrous for an accounting firm relying on ChatGPT to answer complex tax questions.

When you need to get tech support outside of your team

Automations and AI are only as good as your team is at managing them.

As Nintex CFO Eric Emans told CFO Brew, “you don’t want to be beholden, especially in a three-day close period, to having to call your software vendor and say, “Hey, something’s not working.”

If you have an in-house IT team, go ahead and experiment. But if you’re relying on external support, complex automations might unintentionally create contingencies that hit at the worst possible times.

When the process itself is inefficient

As Bill Gates famously said, “automation applied to an inefficient operation will magnify the inefficiency.”

Take, for example, an automation that collects all the necessary information for a senior accountant on your team and sends it to them. It might seem like a great automation at first, but if that accountant is already overworked, it might create a workflow bottleneck that leaves them spending too much time coordinating and delegating.

Automations that scale inefficient processes risk making more work in the long run. That’s why it’s best to start with the simplest automations for straightforward tasks, and build on them from there.

When sensitive client data isn’t protected properly

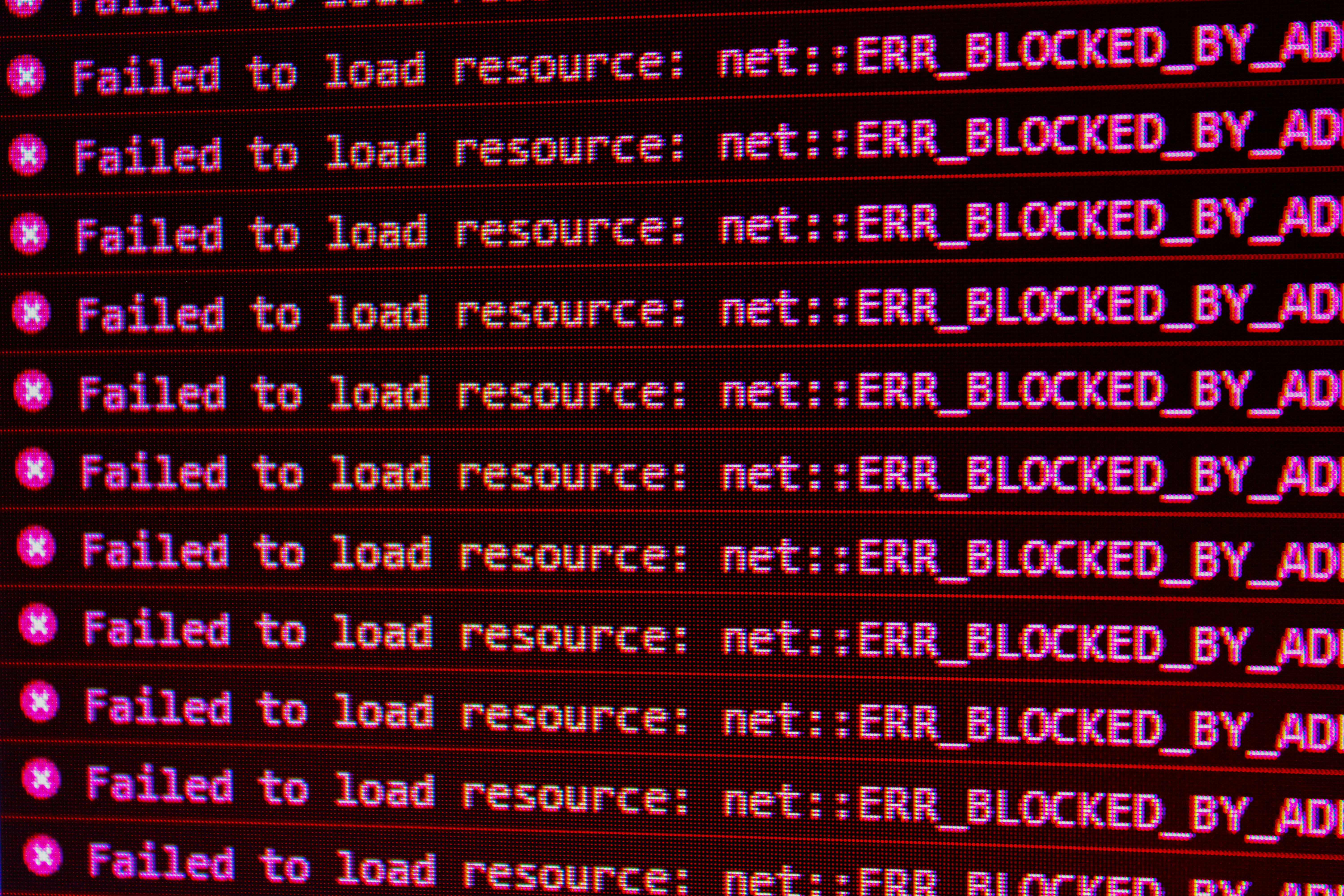

Amid all the hype, it’s easy to forget that LLMs like ChatGPT and Gemini are still very new. That makes them vulnerable to security attacks such as prompt injection attacks that can compromise sensitive business data, especially if you use them in conjunction with API integrations.

Researchers have also created the first generative AI worms, a new type of cybersecurity threat that can travel between AI ecosystems. They haven’t been documented in the wild yet, but the researchers suspect it’s only a matter of time before they start to crop up in LLMs.

This makes it important to create safeguards around AI use, particularly when there’s sensitive client data at stake. Employees should understand not to use client data in ChatGPT prompts, for example, and there should be security frameworks around automations built with Gen AI tools.

When there’s a lot of risk

You might decide to use generative AI to find a way to word client emails – but should you use it for things like audits?

While it’s possible, it’s also complex and risky. Larger firms might have the resources to put the necessary safeguards in place, but for smaller firms, the risk may not be worth the reward. Automating audits requires significant data controls to ensure outputs are accurate and safe, creating risk for companies that don’t have the right resources to pull it off.

The takeaway: automate to the scale of your firm

Ultimately, the scale of your firm will determine the complexity of your automations. Smaller, boutique firms can lean on their relationships with clients and their ability to provide unique value rather than sheer efficiency.

But that doesn’t mean you shouldn’t automate anything! Rather, be selective and automate when you’re sure it can provide value. The best way to start is with the right processes, the right people, and the right platforms.

With ProCharted, you can centralize all your information in one place to speed up manual processes. ProCharted automatically ties together your deadlines, client information, billing, and work items for seamless firm management that can serve as the first stepping stone to AI.

Want to learn more? Try Procharted free for 30 days today!